Previous

Next

Previous

Next

Services

Home / Shop / Restaurant / Office Insurance

Whatever your business, you must protect it with insurance to keep it financially stable even after an unexpected unfavourable event. There is no end to the kind of risks that can wreck your business. It is not possible to stop a risk from attacking, but you can always mitigate the financial hardships and re-establish and run your business by buying the right kind of insurance policy. Insurance takes care of financial consequences and reimburses the insurance policyholder. There are many different types of insurance coverage. The most common are Home Insurance, Shop Insurance, Restaurant Insurance, and Office Insurance.

Home Insurance

Your home represents all the hard work you have done in your lifetime. It is therefore important to give total protection to it. The building, furniture, appliances, jewelry, expensive clothing and artifacts are all part of the home. A single mishap can leave you homeless and nowhere to go. But you don't have to worry if you buy home insurance.

Home insurance will compensate the policyholder for losses of home property by compensating the owner financially. The money can be used for rebuilding, repairing, or replacing damaged properties. This is how home insurance saves people from financial disasters.

Home insurance will compensate the policyholder for losses of home property by compensating the owner financially. The money can be used for rebuilding, repairing, or replacing damaged properties. This is how home insurance saves people from financial disasters.

Restaurant Insurance

Running a hotel is full of financial and accident risks. Restaurants are places that lots of people visit during open hours. Restaurants use stoves, high-pressure steam, and perishable commodity in good quantity. When stale food is served accidentally or there is a fire in the kitchen it can affect all the inmates. Your customers and employees will be affected physically and the building with furniture will be gutted if there is a fire resulting in financial loss to the business owner.

Business owners can buy restaurant insurance and save themselves from financial disasters. When you buy insurance, your insurance company will take care of the financial expenses for rebuilding your business and for paying compensation to eligible customers and employees. Apart from standard restaurant insurance, you can choose to include add-ons such as business interruption for higher coverage.

Business owners can buy restaurant insurance and save themselves from financial disasters. When you buy insurance, your insurance company will take care of the financial expenses for rebuilding your business and for paying compensation to eligible customers and employees. Apart from standard restaurant insurance, you can choose to include add-ons such as business interruption for higher coverage.

Claims Management Support

Simplified claims processing is the hallmark of all our insurance policies. If you have to make a claim, our advisors will help you to prepare and submit the documents. This will assist you with getting reimbursement on time. Our insurance advisors are trained to make a proper claim. We will stay with you till all claims are processed and the claim amount has been transferred to you.

Shop Insurance

Shops and commercial establishments are places visited by a large number of people. It faces a variety of threats and risks. The most well-known risks are fire, burglary, theft, and loss to customers and goods in transit. Stationery shops, departmental stores, or supermarkets, can cover most financial risks with insurance coverage. The advantages of shop insurance are you get compensation for losses suffered. The cost of buying shop insurance depends on the potential estimated loss. Compensation will be limited to actual losses. It can be enhanced if you stock high-value merchandise.

There are multiple add-ons covers to shop insurance. The insurance cost will depend on the sum assured.

Home insurance will compensate the policyholder for losses of home property by compensating the owner financially. The money can be used for rebuilding, repairing, or replacing damaged properties. This is how home insurance saves people from financial disasters.

There are multiple add-ons covers to shop insurance. The insurance cost will depend on the sum assured.

Home insurance will compensate the policyholder for losses of home property by compensating the owner financially. The money can be used for rebuilding, repairing, or replacing damaged properties. This is how home insurance saves people from financial disasters.

Office Insurance

An office is an important place for all businesses. It is here that all important decisions are taken and all valuable documents are stored. Offices are costly to set up and maintain because they require expensive equipment, furniture, and interior decorations. The main risks that offices face is electrical short-circuiting resulting, equipment damages, data losses, and bodily injuries to visitors as well as employees.

Office insurance will mitigate all financial risks with monetary compensation. You can use the compensation for replacing equipment, pay for interior damages, and the cost of recuperating data stored in computers. Office insurance can be combined with other specific insurance covers to make it comprehensive. Comprehensive office insurance will give more value for money.

Covers available for Shop / Restaurant / Office

- Building with Furniture, fittings, and fixtures. Electronic Equipment etc.

- Stock

- Loss of Profits / Business interruption

- Money Insurance

- Fidelity Insurance

- Public Liabilities

- Workmen Compensation

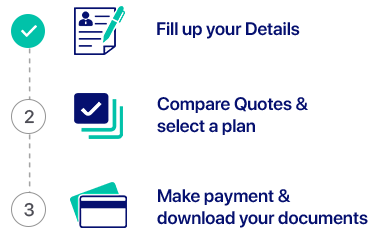

How InsurancePolicy.ae works (Simple, Speedy, Secure)

Contact Us

Speak With One Of Our Experts Today

Phone Number

Why Platinum

50 +

Years of Experience

in the Industry

35 +

Partnerships with Insurers

& Financial Institutions

10,000 +

Clients all Over the Globe

Let’s get started

Appointment

Lets Protect Your Business, Life And Much More

-

41-B Zomorrodah Building, Landmark- Huzaifa Furniture

Umm Hurair Road, Dubai, U.A.E - +971 4 357 7997, 346 6567

- +971 50 473 8811

- hello@pib.ae