Previous

Next

Previous

Next

Services

Endowment Plan in UAE

An endowment plan is a life insurance policy that provides life coverage along with an opportunity to save regularly over a specific period so that the insured can receive a lump-sum amount on the maturity of the policy. One can use this maturity benefit to fulfil various financial needs like funding your children’s education, saving for retirement, buying a house, children’s marriage etc.

The endowment plan not only provides maturity benefit, but in case of eventuality, the beneficiary of the policy also receives the full sum assured amount. Thus, we can describe endowment plan as an insurance plan that allows you to save and offers a lump-sum maturity benefit.

One of the major reasons why one should buy an endowment plan is that it provides an opportunity to save money in a disciplined way to fulfil future financial needs. Moreover, an advantage to this plan is that the insured person also gets life coverage along with an opportunity to build a corpus for a financially secured future. Under endowment policy, returns on the capital are usually tax exempted.* These features make endowment plan more preferable for risk-averse investors as it also provides maturity benefit apart from death benefit offered to the nominee of the policy in case of an eventuality. Our endowment plan services are available in Dubai, Abu Dhabi, Sharjah, Ajman, Umm Al-Quwain, Fujairah & Ras Al Khaimah, UAE

*Please consult your tax advisor for more detailed information.

There are various types of endowment policies available in the market today; both guaranteed and unit linked. At Platinum, we are happy to advice on the best endowment plan to meet your needs. We can suggest risk-free solutions that promise a guaranteed return on a guaranteed date. We consider factors like income, an individual’s needs, current life stage, and risk appetite while recommending the plan.

Other Life Insurance Products

Whole Of Life

Provides a guaranteed sum assured payable on the life assured’s passing with an investment element, which builds up a cash value as well.

Term Life

Provides a guaranteed sum assured payable on the life assured’s passing during a given point in the policy term.

Critical Illness

Provides a guaranteed sum assured should the life assured be diagnosed with any of the specified illnesses.

Business Keyman Protection

Provides a sum assured payable to the business should any high-ranking employees pass away during the policy term to assist with any financial responsibilities for the business.

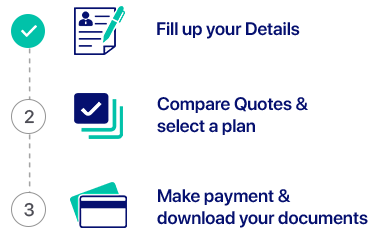

How InsurancePolicy.ae works (Simple, Speedy, Secure)

Contact Us

Speak With One Of Our Experts Today

Phone Number

Why Platinum

50 +

Years of Experience

in the Industry

35 +

Partnerships with Insurers

& Financial Institutions

10,000 +

Clients all Over the Globe

Let’s get started

Appointment

Lets Protect Your Business, Life And Much More

-

41-B Zomorrodah Building, Landmark- Huzaifa Furniture

Umm Hurair Road, Dubai, U.A.E - +971 4 357 7997, 346 6567

- +971 50 473 8811

- hello@pib.ae