Professional Indemnity Insurance

Consequential Loss of Profit Insurance

Losses result in business interruption. Interruptions to business result in lost opportunities and customer patronage. Consequential loss of profit insurance will reimburse you and help your business get to its original status as it was before the loss occurred. The coverage takes immediate effect. There are many other optional extensions that you can include in the basic policy for better coverage.

Professional Indemnity Insurance chiefly focuses on the following type of individuals and firms.

- Medical professionals, Doctors, Nurses, Pharmacists, and Hospitals

- Consulting Engineers, Architects, and Project Managers

- Lawyers, Advocates, and Legal Service Professionals

- Accountants, Bookkeepers, Tax Consultants, and Auditors

- Insurance brokers, Marine Surveyors, Loss Assessors

- IT Consultants, Software, and Application Developers

- Financial Consultants, Fund Managers, Investment Advisors

- Other Consultants (Management, HR, Business, PRO Services, Sports)

- Facilities Managers, Real Estate Consultants…

Coverage at a Glance

- Unintended negligence and misinformation provided by an error of judgment

- Liability arising due to defamation and damage to the reputation of the third person

- Loss of client’s documents or properties and united revelation of secrets

- Damage to goods left in the custody of the professional for safekeeping

- Unintended Infringement of intellectual property

- Wrongful acts of omission and commissions of subcontractors

- Money Transfer Businesses

Excluded Liabilities

Coverage is not available for paying fines and penalties. To be eligible the insured should not have acted maliciously. Coverage will be denied if the insurance company finds that the professional has acted deliberately to defraud the company. Your insurance advisor will tell you how to make a claim fairly and honestly.

Claims Management Support

Simplified claims processing is the symbol of all our cyber security insurance policies. If you have to make a claim, our advisors will help you to prepare and submit the documents. This will assist you with getting reimbursement on time. Our insurance advisors are trained to make a proper claim. We will stay with you till all claims are processed and the claim amount has been transferred to you.

Consequential Loss of Profit Insurance

Professional Indemnity Insurance chiefly focuses on the following type of individuals and firms.

- Medical professionals, Doctors, Nurses, Pharmacists, and Hospitals

- Consulting Engineers, Architects, and Project Managers

- Lawyers, Advocates, and Legal Service Professionals

- Accountants, Bookkeepers, Tax Consultants, and Auditors

- Insurance brokers, Marine Surveyors, Loss Assessors

- IT Consultants, Software, and Application Developers

- Financial Consultants, Fund Managers, Investment Advisors

- Other Consultants (Management, HR, Business, PRO Services, Sports)

- Facilities Managers, Real Estate Consultants…

Additional Coverage Add-ons

- Unintended Infringement of intellectual property

- Wrongful acts of omission and commissions of subcontractors

- Money Transfer Businesses

Coverage at a Glance

- Unintended negligence and misinformation provided by an error of judgment

- Liability arising due to defamation and damage to the reputation of the third person

- Loss of client’s documents or properties and united revelation of secrets

- Damage to goods left in the custody of the professional for safekeeping

Claims Management Support

Excluded Liabilities

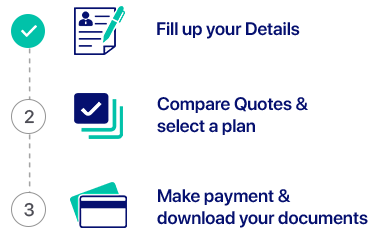

How InsurancePolicy.ae works (Simple, Speedy, Secure)

Speak With One Of Our Experts Today

Phone Number

Why Platinum

50 +

Years of Experience

in the Industry

35 +

Partnerships with Insurers

& Financial Institutions

10,000 +

Clients all Over the Globe

Let’s get started

Appointment

Lets Protect Your Business, Life And Much More

-

41-B Zomorrodah Building, Landmark- Huzaifa Furniture

Umm Hurair Road, Dubai, U.A.E - +971 4 357 7997, 346 6567

- +971 50 473 8811

- hello@pib.ae