Fleet insurance is a type of insurance coverage designed to protect a group of vehicles owned or operated by a single entity, such as a business or organization. In the context of the United Arab Emirates (UAE), fleet insurance is available to businesses and companies with a fleet of vehicles.

Fleet insurance in the UAE works similarly to individual vehicle insurance policies but offers coverage for multiple vehicles under a single policy. It provides a convenient and cost-effective solution for businesses that own or operate a large number of vehicles, such as cars, vans, trucks, or motorcycles.

Here are some key points to know about fleet insurance in the UAE:

Coverage

Fleet insurance typically includes coverage for third-party liability, which covers damages or injuries caused to other parties involved in an accident. Additional coverage options, such as comprehensive coverage for own vehicle damage, theft, fire, and other risks, may also be available.

Cost savings

Insuring a fleet of vehicles under a single policy can often lead to cost savings compared to insuring each vehicle individually. Insurance providers may offer discounts or preferential rates for fleet policies due to the increased number of vehicles involved.

Customization

Fleet insurance policies can be tailored to meet the specific needs of the business. The coverage options, policy limits, and deductibles can be customized based on the size and requirements of the fleet.

Driver Requirements

Insurance providers may have certain criteria for drivers covered under a fleet insurance policy. They may require drivers to meet specific age, experience, and licensing requirements. The insurance premium can be affected by factors such as the driving history of the drivers in the fleet.

Claims management

In the event of an accident or damage to any of the vehicles in the fleet, fleet insurance simplifies the claims process. Businesses can manage claims for multiple vehicles under a single policy, streamlining the administrative tasks involved.

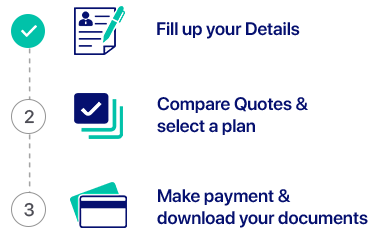

To get fleet insurance for your business, you can follow these general steps:

Assess your fleet

Determine the number and types of vehicles in your fleet that require insurance coverage. This includes cars, vans, trucks, motorcycles, or any other vehicles used for business purposes.

Research insurance providers

Look for insurance brokers in the UAE that offer fleet insurance. Consider their reputation, experience in providing commercial insurance, and the range of coverage options they offer.

Gather necessary information

Prepare information about your fleet, including details about each vehicle, such as make, model, year, and registration numbers. You may also need driver information, including their names, ages, driving experience, and license details.

Compare quotes and coverage

Review the quotes and coverage options provided by different insurance providers. Consider the premiums, deductibles, policy limits, and any additional benefits or features offered by each provider. Assess how well the coverage aligns with your business’s needs and risk profile.

Consult with insurance experts: If necessary, consult with insurance professionals or brokers who specialize in fleet insurance. They can provide guidance and advice on selecting the most appropriate coverage for your fleet and help you navigate the insurance landscape.

Make a decision and purchase the policy

Once you have gathered all the necessary information, compared quotes, and evaluated the coverage options, select the insurance provider that best meets your requirements. Complete the application process and provide any additional documentation or information requested. Review the policy terms and conditions carefully before finalizing the purchase.

Manage your fleet insurance

After obtaining fleet insurance, maintain proper records of your vehicles, drivers, and any changes that occur within your fleet. Stay in touch with your insurance provider for any updates, policy renewals, or changes in your coverage needs. If you add or remove vehicles from your fleet, inform your insurance provider promptly to ensure accurate coverage.

Remember that the process of obtaining fleet insurance may vary slightly depending on the insurance provider and their specific requirements. Working closely with an insurance professional can help you navigate the process more effectively and ensure that you have the right coverage for your business’s fleet.

To obtain fleet insurance in the UAE, it is advisable to contact insurance providers or brokers specializing in commercial or fleet insurance. They can assess your specific needs, provide you with quotes, and guide you through the process of obtaining the appropriate coverage for your fleet.